BLOGS

21 May 2025

How Aadhaar OCR Integration for Identity Verification Enhances KYC Compliance

The fintech sector is undergoing through phase of fast digital transformation, reshaping the future of how financial services are delivered and consumed. From mobile payments to digital lending platforms, technology is driving speed, convenience, and scalability. To make this shift possible robust and seamless identity verification solutions are required—an area where Aadhaar OCR Integration for Identity Verification is making a significant impact.

As regulatory requirements become mandatory and customer expectations grow, the demand for fast, reliable, and compliant KYC (Know Your Customer) processes has become absolute necessity. Traditional identity verification methods often involve manual data entry, document uploads, and long waiting times, results in the slow user onboardings. Aadhaar OCR Integration for Identity Verification can be a game changer in addressing these issues by automating data extraction and verification, significantly reducing onboarding time.

Among the various innovations making a significant impact in transforming fintech sector, Aadhaar OCR Integration for Identity Verification plays a key role in this transformation due ability to enhance both user experience and regulatory compliance. By leveraging OCR technology to extract information directly from Aadhaar cards, fintech platforms can instantly validate identity data, ensuring accuracy and reducing the risk of fraud.

This blog explores how Aadhaar OCR Integration for Identity Verification plays a key role in strengthening KYC compliance. We’ll look at its technology, benefits, and the value it brings to fintech companies aiming to scale efficiently without compromising on compliance with government regulations.

What Is Aadhaar Card OCR?

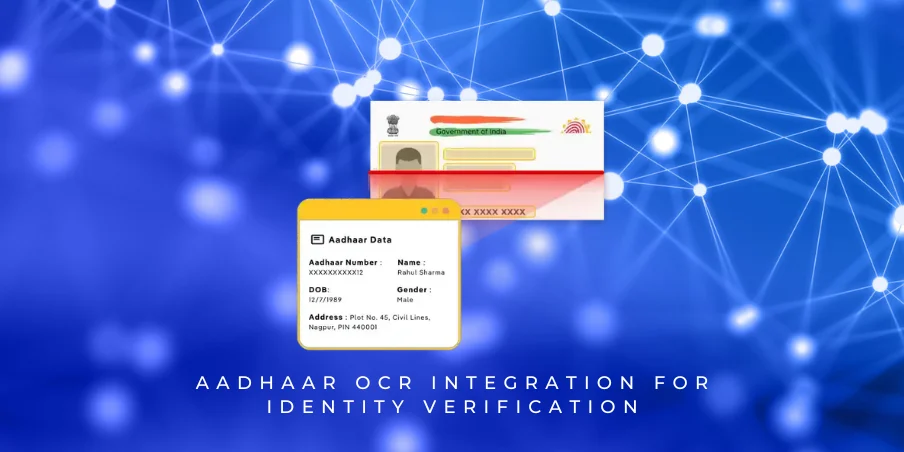

Optical Character Recognition (OCR) is a technology that makes it possible for computers to read and extract text from images or scanned documents. In the context of Aadhaar cards, OCR reads printed information on Aadhaar cards—such as name, date of birth, Aadhaar number, gender, address—and converts it into machine-readable data. Aadhaar OCR Integration for Identity Verification uses this technology to automate identity verification in a fast and accurate manner.

When a user provides an image or scanned copy of their Aadhaar card, OCR software processes the image and extracts key details such as the name, gender, date of birth, address and unique Aadhaar number. This extracted data can then be instantly validated with data from governmental sources. Aadhaar OCR Integration for Identity Verification ensures that the verification process is seamless, reducing manual errors and significantly speeding up onboarding workflows.

Traditional, identity verification involves manually entering user details from physical documents, which is time-taking process and prone to human error. In contrast, Aadhaar OCR Integration for Identity Verification replaces this manual process with automated extraction and validation, leading to faster, more reliable, and scalable KYC processes for fintech companies.

KYC Compliance in Fintech: A Quick Overview

Know Your Customer (KYC) is a process used by financial institutions to verify the identity of their clients. It helps preventing illegal activities such as money laundering, fraud, and terror funding. For digital platforms, Aadhaar OCR Integration for Identity Verification is emerging as a game changer to streamline this process while ensuring compliance with guidelines issued by governing bodies.

In India, KYC compliance is governed by several key regulatory institutions, including the Reserve Bank of India (RBI), the Securities and Exchange Board of India (SEBI), and the Insurance Regulatory and Development Authority of India (IRDAI). These authorities have issued strict guidelines to ensure that customer data is verified and stored securely. Aadhaar OCR Integration for Identity Verification enables fintech companies to comply with these regulations more effectively through automated and secure identity verification.

Despite regulatory guidelines being in place, fintech companies meet with several challenges when implementing KYC. Common issues include document verification delays, manual data entry errors, and fraudulent document submissions. Aadhaar OCR Integration for Identity Verification addresses these issues by automating data extraction and validation, minimizing human intervention and error.

Another major concern for fintech companies is user onboarding drop-offs due to slow and complicated verification procedures. Aadhaar Card OCR API for Identity Verification significantly improves the user experience by making the process fast and more reliable, reducing friction and increasing conversion rates during onboarding.

How Aadhaar Card OCR Integration Works in Fintech Workflows

The process starts with the user uploading an image or scanned copy of their Aadhaar card during onboarding. Thanks to Aadhaar Card OCR API for Identity Verification, the system can quickly capture and process the document without manual intervention, simplifying the first step of identity verification.

Once the Aadhaar card image is received, the OCR system analyzes the document and extracts key fields such as name, date of birth, Aadhaar number, gender, and address. This automated extraction, made possible by Aadhaar Card OCR API for Identity Verification minimizes human intervention and errors, ensures accuracy in capturing vital customer data.

Once data extraction is complete, the information is validated and cross-checked against backend systems or government sources to verify authenticity. This crucial step in Aadhaar OCR Integration for Identity Verification helps fintech companies detect fraud and remain compliant with regulatory guidelines.

Finally, the extracted and validated data is used to automatically fill KYC forms, significantly speeding up the onboarding process for users. This seamless flow, enabled by Aadhaar Card OCR API for Identity Verification ensures both efficiency and reliability in fintech workflows.

Benefits of Aadhaar Card OCR Integration for Fintech Identity Verification

Faster Customer Onboarding

Aadhaar OCR Integration for Identity Verification accelerates the customer onboarding process by instantly extracting and verifying identity data. This reduces the time taken to verify documents, allowing users to access fintech services quickly.

Minimized Manual Errors

Manual form filling often leads to typos or mismatches in critical fields. Aadhaar Card OCR API for Identity Verification automates this process, significantly reducing human errors and improving the reliability of customer records.

Improved Accuracy and Data Integrity

With Aadhaar Card OCR API for Identity Verification, extracted data is accurate and error free. This technology ensures high-quality results, maintaining the integrity of KYC data across the system.

Real-Time Identity Verification

Aadhaar OCR Integration for Identity Verification enables real-time extraction and validation of Aadhaar data, making it possible for fintech platforms to approve applications instantly while following compliance guidelines.

Reduced Risk of Fraudulent Documents

By automating the verification process, Aadhaar Card OCR API for Identity Verification helps detect fake or tampered documents early. This helps in minimizing frauds for both fintech companies and their customers.

Compliance with RBI-Mandated KYC Norms

Regulatory compliance is crucial in the fintech sector. Aadhaar Card OCR API for Identity Verification ensures that fintech platforms strictly follow RBI-mandated KYC norms efficiently and securely.

Scalability for High-Volume Fintech Platforms

Fintech platforms can scale easily with Aadhaar OCR integration, which enhances identity verification to meet their growing needs. Whether onboarding hundreds or millions of users, the technology supports seamless, consistent KYC processing.

Real-World Applications in Fintech

Aadhaar Card OCR API for Identity Verification has revolutionized digital lending apps by providing instant extraction and verification of customer identity data. This allows lenders to reduce processing time drastically while ensuring compliance with governmental norms.

In the case of neobanks, Aadhaar OCR Integration for Identity Verification streamlines the onboarding process by automated form filling and identity verification. This not only enhances user experience but also strengthens fraud prevention measures.

For investment platforms, Aadhaar Card OCR API for Identity Verification simplifies regulatory compliance by accurately extracting and validating customer information. This helps platforms onboard investors faster while adhering to stringent KYC requirements.

During insurance onboarding, Aadhaar OCR Integration for Identity Verification makes faster issuance of policies by automating data extracting and verification, reducing manual workload and human error. Finally, wallets and UPI apps benefit from Aadhaar Card OCR API for Identity Verification by offering real-time identity verification, ensuring secure transactions and building customer trust.

Best Practices for Implementing Aadhaar OCR in Fintech

To get the most out of Aadhaar Card OCR API for Identity Verification, fintech companies should start by selecting a high-accuracy, fast, and reliable OCR engine. The chosen solution must support multiple languages, deliver quick results, and maintain a high level of precision when extracting key details from Aadhaar Cards.

An API-first architecture is essential for seamless Aadhaar OCR Integration for Identity Verification.

This allows fintech developers to easily integrate OCR capabilities into onboarding workflows, ensuring reliability and scalability with minimal disruption to existing systems.

Security should be a top priority in Aadhaar Card OCR API for Identity Verification. Implementing end-to-end encryption ensures that sensitive identity data remains protected during both transmission and storage, making this process safe for both the platform and its users.

Regular system audits and performance checks are essential to maintain the accuracy of Aadhaar OCR Integration for Identity Verification. Fine-tuning the OCR engine based on real-world data helps reduce false positives and improves overall accuracy and performance.

Lastly, educating customers is a key part of responsible Aadhaar Card OCR API for Identity Verification. Fintech platforms should educate users about safe Aadhaar sharing practices, reinforcing trust and encouraging compliance with privacy standards.

Conclusion

In the fast-changing fintech ecosystem, ensuring seamless, secure, and compliant identity verification is no longer optional—it’s a necessity. Aadhaar OCR Integration for Identity Verification plays a key role by automating the extraction of identity details from Aadhaar documents, minimizing manual errors, and enabling faster user onboarding.

When combined with APIs that validate extracted data from Aadhaar Cards against official government records, fintech platforms get a powerful, end-to-end KYC solution. This dual approach not only enhances accuracy and reduces fraud but also ensures strict adherence to regulatory guidelines. Together, OCR technology and verification APIs create a complementary system that builds trust, speeds up verification, and scales effortlessly with growing user bases.

By adopting Aadhaar Card OCR API for Identity Verification alongside robust data validation APIs, fintech companies can provide faster, smarter, and more reliable onboarding experiences—while remaining fully compliant with governmental KYC norms.